A Sole Proprietorship Must Register With Which of the Following

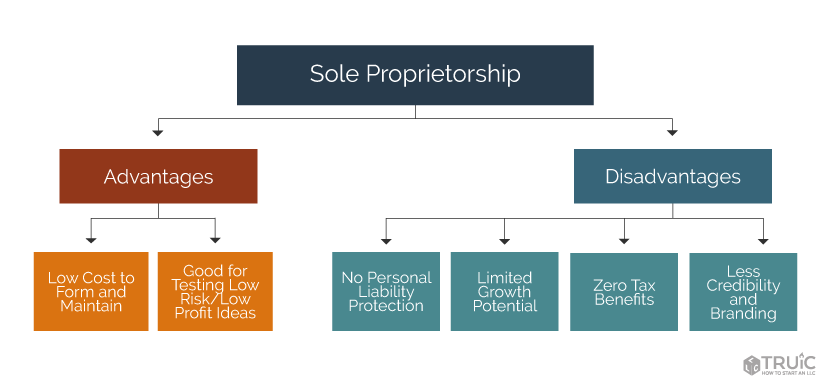

Starting a sole proprietorship is the simplest way to set up a business. As defined by the IRS a sole proprietor is someone who owns an unincorporated business by himself or herself The key advantage in a sole proprietorship lies in its simplicity.

Sole Proprietorship Sole Proprietorships Are The Most Common Type Of Online Business Due To Their Simpli In 2021 Sole Proprietorship Sole Proprietor Goods And Services

A sole proprietor has total control receives all profits from and is responsible for taxes and liabilities of the business.

. If you have employees you must report and pay employment taxes on a periodic basis. Rental property condominiums townhouses cottages rooms etc in Ocean CityWorcester County Unincorporated must file a Form 7. A creditor with a claim against a sole proprietor would normally have a right against the sole proprietors.

The sole proprietor is said to be self -employed. A sole proprietorship is an unincorporated business that is owned by one individual. Here there is no distinction between the business and the individual.

The owner of a sole proprietorship has sole responsibility for making decisions receives all the profits claims all losses and does not have separate legal status from the business. Following is a brief overview of each entity and the documents you would need to file with the office. Pay your taxes and other creditors and issue your final payroll.

The shareholding of the proprietor should not be less than 50 of the voting power and the same must continue to be held for a period of 5 years. As soon as you begin doing business by yourself and in some states with your spouse you have a sole proprietorship. In the eyes of the law the sole proprietorship and the owner are one and the same.

There is no fee to dissolve a sole proprietorship or partnership. If someone brings a lawsuit against a sole proprietorship it is the same as suing the owner. More information related to employment taxes can be obtained by registering with the Tennessee One Stop Resource.

It is the simplest kind of business structure. The request to dissolve must be done separately. When to Use a Sole Proprietorship.

A sole proprietorship is the most common and simplest form of business structure. The dissolution date must be on or after the registration date. Sell off your assets and inventory.

Sole Proprietorship specifically is designed for the single business owner. You can register a trade name when you complete your Washington Business License Application at a cost of 5 per. This establishes a small business with 1 individual as the business owner and operator.

Sole Proprietorships and General Partnerships must file a Form 2 Personal Property Tax Return no fees apply. Open a business bank account. You earned more than 1000 from self-employment between 6 April 2021 and 5 April 2022 you.

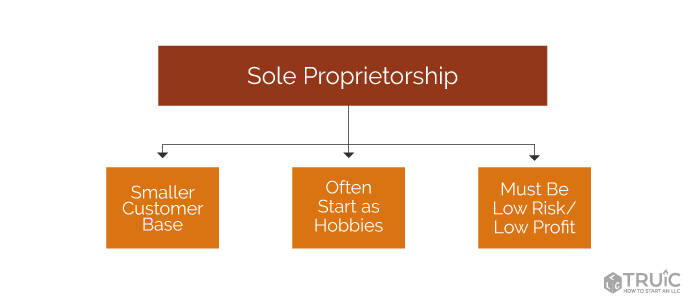

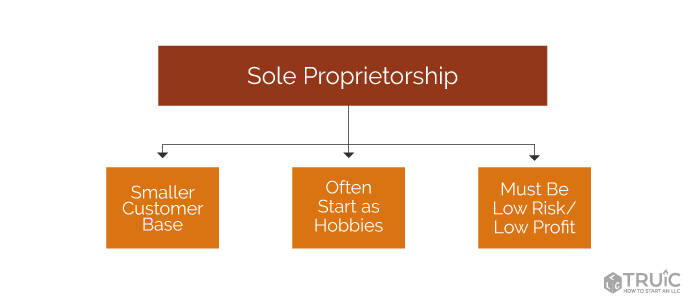

They MUST be low-profit and low-risk. A Sole Proprietorship is under the classification of setting up a business known as Master Business Licences. While the owner is entitled to all profits from the business he is also responsible for the business.

It is important to consider doing the following once you have established your sole proprietorship. The owner of a sole proprietorship is. Sole proprietorships are best for small businesses with the following traits.

Dissolutions cannot be submitted online. As a sole proprietor you would be fully responsible for all debts and obligations related to your business. A sole proprietorship is not a separate legal entity apart from the owner.

When the business owes a debt so does the owner. Pay off and cancel. If you are a sole proprietor.

Details about registering a Sole Proprietorship. The term sole proprietorship refers to a business owned and operated by one person which is not registered as a corporation or a limited liability companyIn a sole proprietorship there is no legal distinction between the individual and the business owner. But check your states requirements if you filed your partnership agreement with the state.

John Smiths Fishing Shop a Fictitious Business Name Statement must be filed with. A sole proprietorship is set up to allow an individual to own and operate a business. A sole proprietorship exists when a single individual who owns all of the businesss assets engages in business activity without the necessity of having to have a formal organization.

Legal Entity names become record when you file a legal entity such as an LLC or Corporation. A sole proprietor is personally liable for all debts and liabilities. A sole proprietor must invoice receive payment open a bank account and market with their surname unless their state allows them to register and maintain a doing business as DBA name.

Owned by 1 individual. Wrap Up Your Business Finances. The Memorandum of Association MOA needs to carry the object The take over of a sole proprietorship.

To dissolve a business complete one of the following forms and follow instructions on the form to submit it. You need to set up as a sole trader if any of the following apply. A sole proprietorship is a form of business in which an individual owns the business with no other owners.

If your business is a corporation or limited liability entity the name must indicate the type of entity such as Corp Inc LLC etc. All the assets and liabilities of the sole proprietorship must be transferred to the company. A sole proprietorship is the most common type of business structure.

If a sole proprietorship is formed with a name other than the individuals name example. You dont need to file dissolution articles to close a sole proprietorship or general partnership.

Reading Sole Proprietorship And Partnerships Introduction To Business

Learn About Proprietorship Chegg Com

What Is A Sole Proprietorship A How To Start An Llc Small Business Guide

What Is A Sole Proprietorship A How To Start An Llc Small Business Guide

Comments

Post a Comment